“When the capital development of a country becomes a by-product of the activities of a casino, the job I likely to be ill-done.”

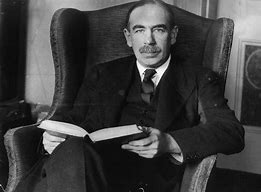

John Maynard Keynes was a British economist and member of the old Liberal Party. He opposed what he considered the damaging economic terms imposed on Germany after the First World War and the deflationary policies used by most governments to tackle the Great Depression in the 1930s. After the Second World War, Keynesian demand management was adopted by parties of both the centre-left and the centre-right and most historians believe that this was responsible for the long boom in Europe and North America between 1945 and the early 1970s.

Since the oil price shocks after 1973, Keynesian economics has fallen out of fashion and an old idea in a new form has dominated economic policy since the mid-1970s. Call it what you will – laissez-faire, deflation, supply-side, inflation-targeting, Thatcherism or neoliberalism – the essential idea is the same. This is that tax cuts for the rich and cutting government spending are the best ways to increase economic growth – the ‘trickle down’ theory that making the rich even better off somehow makes the rest of society better off.

This ‘trickle down’ idea may (!) have worked in an economic system based on nation states with national banks and controls on moving money abroad. Richer people would have choice but to invest in their own countries or to leave their money in national banks where it could be taxed by their own government. But we no longer live in such a world. When rich people have been given tax cuts, they have not invested in their own countries but salted their gains away in terrifyingly lax tax haves – see my review of Moneyland by Oliver Bullough. Money that could and should have been used for investment is instead lost, usually forever.

It is clear that the world is suffering through the birth pangs of a whole new economy. In the UK at the satrt of the Industrial Revolution, there were waves of protests against new technology in both cities (the Luddites) and the countryside (Captain Swing). A tide of what the media lazily calls ‘populism’ has swept countries as diverse as the USA, France and Hong Kong. What is clear is that whilst some very wealthy people have done extraordinarily well out of globalisation, many poorer people have not. This is only going to get worse as we teeter on the brink of major breakthroughs in robotics and automation.

One ‘industry’ that has done well out of globalisation is finance. Bankers have made huge profits over the past three decades and have had their losses covered by public money – for example, in the misnamed ‘bailout’ of Greece, which was actually a rescue of the banks that owned Greek state debt. These obscene profits, coupled with inflation-busting rises in the rise of property, has created a super-wealthy class of rentiers whose lives are completely cut off from those of ordinary working people.

This is what John Maynard Keynes means when capital development is akin to a casino. A casino is at least fair but the economy as it has developed over the past thirty years is more like a rigged roulette wheel. If you are already well-off, you can make a lot of money from a casino economy. Not only that but it is pretty obvious that an ‘old boy’ public school network still dominates finance and banking.

What is to be done? I really don’t know although we cannot allow the current structure of the world economy to continue as it is simply not working for the vast majority. At the same time, a small number of people are making vast fortune. So long as this disconnect continues, there are going to be more challenges to the status quo from so-called populists. And dismissing such people as racists, xenophobes or fascists, as the ruling class and its media shills are wont to do, is not going to lead to a fairer and more balanced political system and economy any time soon.

One thought on “Quote Of The Day #77”